Posted on December 31, 2021

Content

Forex Trading & Wave Analysis

1 or 5 could be longer than Wave three, but both can’t be longer than Wave 3. It is probably best to make use of percentages or log scales when measuring Wave size. Elliott Wave signifies that Wave 3 should exceed the excessive of Wave 1.

“We Trade Waves” Exclusive Forex Trading Tips

That is the equivalent of a surfer surfing in only pristine circumstances, not figuring out the pitfalls of browsing with too much wind, too much current, or too harmful waves. What would happen if the surfer only surfed in excellent circumstances and then went out and surfed in dangerous, unstable https://www.binance.com/ waves? Without being prepared for various surf circumstances, the surfer came unwell – prepared for the duty at hand. I gained’t go into any particulars on specific firms, but somewhat provide an insight into the methodology and strategy of my buying and selling.

Scroll Down To Check Our “Weekly Forex Forecast”

The first guideline is that wave 3 is the longest of the impulse waves throughout the Elliot wave construction. The second guideline is that wave 2 and wave 4 will alternate when it comes to their corrective nature. For example, if wave 2 is a pointy correction, wave 4 might be a flat correction. The third guideline is that following a surge in wave 5, the correction ABC often ends in the prior wave 4 low level. Even though Wave 3 is typically the longest of the three impulse waves, there’s a particular rule that it can’t be the shortest.

How Do We Get More Than 70% Accuracy In Our Forex Trading & Wave Analysis Forecasts?

In the primary small 5-wave sequence, waves 1, three and 5 are motive, while waves 2 and 4 are corrective. This signals that the movement of the wave one diploma greater is upward. It also alerts the start of the first small three-wave corrective sequence.

The third wave of a pattern is commonly the most important, usually a lot bigger than wave one. Wave 4 comes subsequent and is usually 30 to forty % the dimensions of wave three. For instance, if wave three rallied $three, the price is likely to drop $zero.ninety to $1.20 during wave four.

Based on the analysis of Nelson, wave two is usually 60 percent the size of wave one. If wave one advances $1, then wave two will doubtless see the value drop by about $zero.60. If it is the begin of a downtrend, and wave one was $2, the correction to the upside is commonly about $1.20. An impulse wave is a big worth transfer and has related trends.

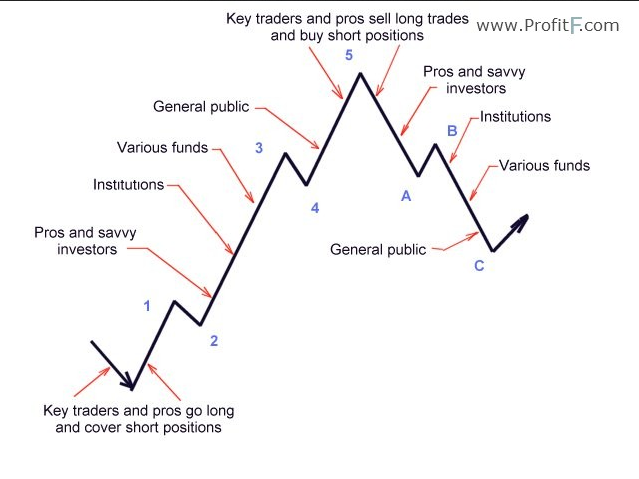

Take a take a look at the snapshot under to make out the part of the Elliot wave that constitutes the motive waves, and the part which constitutes the corrective wave. In this piece, we sort out the motive waves and their relevance to merchants. Technical evaluation of shares and trends is the research of historic market knowledge, including price and quantity trading waves, to predict future market conduct. In the monetary markets, we all know that “what goes up, must come down,” as a value movement up or down is at all times followed by a opposite motion. Trends present the main course of prices, while corrections move against the pattern.

Sit and wait, be content material with waiting for the proper commerce or the best wave. If you attempt to trade an excessive amount of, or try https://beaxy.com/market/waves-btc/ to surf an excessive amount of, you’ll put on out your capital and your body in brief time. Unfortunately for me, I was born into one of the biggest bull rallies of all time.

Degrees are relative; they are defined by type, not by absolute size or duration. Waves of the same diploma may be of very totally different size and/or length. In wave four, many merchants lock in revenue, whereas many others are able https://www.coinbase.com/ to commerce counter the development. A pullback occurs slowly, takes a very long time, and normally reached 38.2%, extra hardly ever 50.zero% of wave 3. The higher begin you give your self, the higher the possibilities of early success.

- Impulse wave sample is utilized in technical analysis referred to as Elliott Wave Theory that confirms the path of market trends via short-time period patterns.

- You might want to detect the most widespread patterns and understand at what circumstances you may open trades.

- Elliott’s market mannequin relies heavily on looking at worth charts.

- Elliott Wave evaluation is among the most complex methods of forecasting market movements on monetary markets.

- However, for successful buying and selling, just the fundamentals of this analytical method may be enough.

- These temper swings create patterns evidenced within the value movements of markets at each degree of pattern or time scale.

When a squeeze fires, we wish to see that the A, B and C Waves are in settlement with the path of the sign. If a squeeze fires short but the waves are clearly constructive and exhibiting bullish momentum, we may choose to not take the sign since it might be preventing the general market development. The chart under is an instance of a perfect setup utilizing the waves.

With tight spreads and an enormous range of markets, they provide a dynamic and detailed trading setting. December 10, The broker you select is an important funding decision. The risk and reward ratio is elevated, making brief term trades extra viable.

Its knowing what I know, and knowing what I don’t know. I don’t know what its prefer to commerce in a severely bearish market as a result of I haven’t lived through one. These past 8 years have been some of the greatest occasions to be an investor.

It’s my passion, so I don’t consider it as distracting or “working” while on vacation. Limited Edition is proud to present “TRADING WAVES”.Michael Novy and Jones Russell trade waves at probably the greatest wedges on the East Coast.

When I imply regularly, I imply each single damn time. However, as I was crashing I thought of how this might relate to buying and selling (like several rational person would do, proper?). The method this applies to buying and selling is straightforward, but yet powerful. I’ve come to the conclusion that I can not get away from the markets, mainly as a result of I love them so much.

Frost Memorial Award was awarded to Robert Prechter in 1999, with whom Frost co-authored Elliott Wave Principle in 1978. The patterns hyperlink to type five and three-wave buildings which themselves underlie self-comparable wave structures of accelerating size or greater degree.

A breakaway hole is a price hole that forms on the completion of an essential price sample. It normally indicators the beginning of an essential price move.

A runaway hole is a worth gap that normally happens around the mid-point of an necessary market pattern. An exhaustion gap is a price hole that occurs on the finish of an necessary pattern and signals that the development is ending. Traders could enhance their counting by making use of the 3-rules and 3-tips to their wave counting. If you apply the foundations for the first count and pointers for the second you’re prone to consider the waves within the correct manner. By eliminating false waves you might be able to goal particular areas of a pattern and enhance ranges to provoke a commerce or take revenue.

I was just young sufficient to not realize the magnitude or influence of the monetary disaster, and commenced my funding journey at thirteen years of age. Because of this, I’ve had to study from historical past about what can occur in markets, and what horrible markets seem like, understanding solely good occasions since my funding journey. Its this information that issues aren’t all the time like this (the present market bull run) which provides me an edge in my buying and selling.

Practitioners commonly use this ratio and associated ratios to determine support and resistance levels for market waves, particularly the worth points which help define the parameters of a pattern. Corrective wave patterns unfold in varieties generally known as zigzags, flats, or triangles. In flip these corrective patterns can come together to kind extra complicated corrections. Similarly, a triangular corrective sample is fashioned normally in wave 4, but very rarely in wave 2, and is the indication of the end of a correction. Each diploma of a pattern in a financial market has a name.

Day buying and selling with Bitcoin, LiteCoin, Ethereum and different altcoins currencies is an expanding business. Gold had an excellent week — yet for merchants, “good” is dependent upon the power to anticipate the development beforehand. Which raises the query, what reason did gold bulls need to be bullish? Watch Chart of the Day to see how we reply that query. The waves additionally work properly as a affirmation for the TTM Squeeze indicator.

Notice that every one three waves, representing three different time frames, all cross the zero line and go constructive just after the cash market session opens. The waves will not at all times cross at the same time however once they do, this is typically considered as a stronger signal. An up hole is formed when the bottom price on a buying and selling day is larger than the very best high of yesterday. A down hole is fashioned when the best price of the day is lower than the lowest price of the prior day. An up gap is often a sign of market power, while a down hole is an indication of market weak spot.

Failure to exceed this high would call for a re-count. Failure to exceed the high of Wave 2 would not be making progress. The motive wave might current opportunities to commerce with the prevailing development till the trend ends. This signifies that there are opportunities to buy at the commencement of waves 3 and 5 in an uptrend, and opportunities to sell at the start of waves three and 5 in a downtrend. It is important to have an thought as to the place a wave will begin and end, as a result of these things do not just pop straight out of the charts.

Close your eyes, flip by way of Investors Business Daily, and randomly select an organization and odds are you would be making greater than your principal on your funding. That doesn’t mean anybody can do it, but when one was to buy the S&P 500 Index, they would’ve made a handsome revenue over the last 7 years.

An uptrend keeps reaching greater prices as a result of the strikes up are larger than the moves down which happen in between these large up waves. The third largest cryptocurrency trade on the https://beaxy.com/ planet will now offer buying and selling WAVES in 2 pairs, in opposition to BTC and ETH. When learning tips on how to surf, I began on small waves and crashing frequently.

To my defense, the waves were very large and difficult in general. But while I was out within the ocean letting the waves decide where to take me, I thought of markets, funding opportunities, and the waves. Along with a wave, a thought hit me that garnered a writing piece. My strategy to the markets is strictly like surfing in 4 major ways. The Fibonacci sequence can also be intently connected to the Golden ratio (1.618).